2025 Bank Valuations and the M&A Environment Featuring Joseph Moeller of KBW

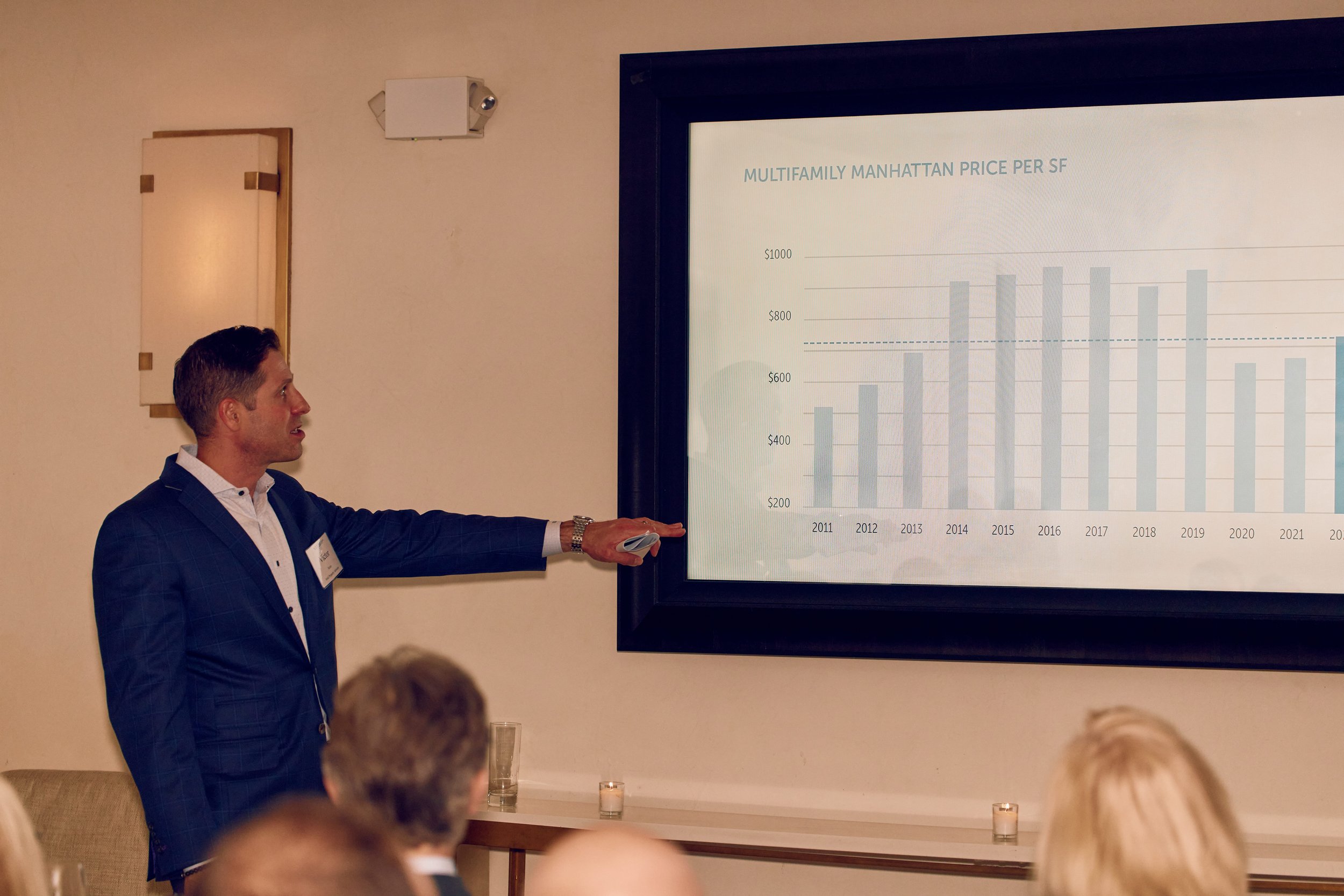

On April 9, 2025, Joe Moeller, Managing Director of Keefe, Bruyette & Woods (KBW), delivered a timely presentation on bank valuations and the M&A environment to the NYLIB community at Pryor Cashman’s offices in Times Square.

On April 9, 2025, Joseph Moeller, Managing Director of Keefe, Bruyette & Woods (KBW), delivered a timely presentation on bank valuations and the M&A environment to the NYLIB community at Pryor Cashman’s offices in Times Square.

Following cocktails and an opportunity for networking, Joe provided an overview of the performance of bank stocks since the election, the overall performance of the banking industry since 2020, the potential impacts of tariffs on the economy and bank earnings, the quickening pace of regulatory approvals for bank transactions, the outlook for bank stocks going forward, the stratification of bank valuations by asset size, and the likelihood of continued consolidation in the banking industry. Joe answered a number of questions from the audience, and a robust discussion was had.

Our Moderator

Joseph Moeller joined KBW in 1994. His responsibilities include corporate finance advisory, mergers and acquisitions, and capital markets transactions for financial services companies primarily located in the Mid-Atlantic region of the U.S. Earlier in his career, Joe worked in the Bank Supervision Group of the Federal Reserve Bank of New York.

He received a BS in Industrial Management and Economics from Carnegie Mellon University in Pittsburgh, PA, and attended classes at New York University’s Stern School of Business.

Joe’s recent advisory assignments have included:

Flushing Financial Corporation’s (NY) $70 million follow-on offering of common stock – Closed 12/12/2024

Financial Institutions, Inc.’s (NY) $100 million follow-on offering of common stock – Closed 12/11/2024

Dime Community Bancshares, Inc.’s (NY) $144 million follow-on offering of common stock – Closed 11/12/2024

ConnectOne Bancorp, Inc.’s (NJ) $284 million merger with The First of Long Island Corp. (NY) – Announced 9/5/2024

Lakeland Bancorp’s (NJ) $1.3 billion merger with Provident Financial Services, Inc. (NJ) – Announced 9/27/2022

Investors Bancorp’s (NJ) sale to Citizens Financial Group, Inc. (RI) ($3.6 billion) – Closed 4/6/2022

Sterling Bancorp’s (NY) $5.4 billion merger with Webster Financial Corporation (CT) – Closed 1/31/2022

The Audience

Eric Segal, Managing Director of CFO Consulting Partners and Director and Chairman of the Asset Liability Management Committee at Orrstown Bank, poses a question.

NYLIB President Ed Lutz commented: “It’s always interesting when Joe Moeller presents at NYLIB! The last time we scheduled Joe to present on bank valuations and the M&A environment, Silicon Valley Bank and Signature Bank failed. This time, the markets were roiled by President Trump’s April 2nd announcement about tariffs. In both instances, Joe did a great job of incorporating the latest information and providing timely and important insights and advice to NYLIB members and friends.”

Sponsorship & Future Events

As NYLIB continues to plan events and meetings, we are open to suggestions on topics or issues that interest banks in the tri-state area. Subscribe to our mailing list below to stay informed on news and upcoming events. If you’re interested in sponsoring future NYLIB events, please fill out this contact form, and a member of our team will reach out to you.

From left to right: Joseph Pistilli (Chairman, First Central Savings Bank), Kevin Kane (President, Financial Regulatory Consulting Inc.), and Michael Serao (EVP & Chief Administrative Officer, First Central Savings Bank)

Memorable Moments

Please enjoy more memorable moments from our evening here. We encourage you to download your favorite moments and share them on LinkedIn. Don’t forget to tag the New York League of Independent Bankers (NYLIB)!

2024 Annual Regulator Roundtable

NYLIB hosted our 2024 Annual Regulator Roundtable event. Steve Bush, Chairman, President, and CEO of Apple Bank, moderated the pane discussion. Featured speakers included Janis Frenchak, Head of Consumer Compliance, Federal Reserve Bank of New York; Tracy Velez, Associate Deputy Comptroller for the Northeast, the Office of the Comptroller of the Currency; and Raymond Dorado, Acting Executive Deputy Superintendent — Banking, New York State Department of Financial Services.

On Thursday, November 21, 2024, NYLIB hosted our Annual Regulator Roundtable event. The panel discussion was moderated by Steve Bush, Chairman, President, and CEO of Apple Bank. Featured speakers included Janis Frenchak, Head of Consumer Compliance, Federal Reserve Bank of New York (FRBNY); Tracy Velez, Associate Deputy Comptroller for the Northeast, Office of the Comptroller of the Currency (OCC); and Raymond Dorado, Acting Executive Deputy Superintendent — Banking, New York State Department of Financial Services (DFS).

From left to right: Dustin Nofziger (Attorney, Pryor Cashman LLP), Steve Bush (Chairman, President & CEO, Apple Bank), Janis Frenchak (Head of Consumer Compliance, Federal Reserve Bank of New York), Tracy Velez (Associate Deputy Comptroller for the Northeast, Office of the Comptroller of the Currency), Raymond Dorado (Acting Executive Deputy Superintendent — Banking, New York State Department of Financial Services), Edward Lutz (President, NYLIB).

The topics discussed included the lessons learned since the March 2023 bank failures, and how regulators’ views on topics such as capital and liquidity have evolved since late 2023; examination report timeliness and appropriate MRA remediation timeframes; the surprising resilience of the CRE market and the importance of appropriately risk rating secondary sources of repayment; prudent practices with respect to artificial intelligence and instant payments; the growing risk posed by check fraud; the importance of third-party risk management and strong due diligence on third party partners and contracts; cybersecurity risks posed by remote employees and the importance of timely upgrades to access controls; and the importance of robust succession planning on both an executive and director level.

Moderator

Steve Bush, President and CEO of Apple Bank, served as moderator of the panel discussion. Steve previously served as Executive Vice President and Chief Operating Officer at Apple Bank, with oversight for the bank's lending units, as well as financial, risk management, planning, and operating functions. Steve joined Apple Bank in 1992 from Chemical Bank, where he was a Vice President in the Asset and Liability Management and Finance Divisions.

Panelists

Janis Frenchak leads Consumer Compliance Supervision for the Federal Reserve Bank of New York. In this role, she oversees consumer compliance holding companies’ supervision for firms over $10B, as well as Community Affairs (CA) and Community Reinvestment (CRA) examinations for all-size state member banks. Prior to joining the Federal Reserve Bank of New York, Janis was an officer and Assistant Vice President of the Federal Reserve Bank of Chicago for the Consumer Compliance Division, specializing in CRA, Fair Lending, and Unfair or Deceptive Acts or Practices (UDAP). Before joining the Federal Reserve System, she was the Vice President of a large, international banking organization, where she led the Fair Lending and UDA(A)P programs for national operations and across multiple consumer business lines, including mortgages, auto, commercial, and consumer loans. She also previously worked for the Economic Development Agency for Cook County, Illinois.

Tracy Velez is the Associate Deputy Comptroller (AsDC) in the OCC’s Northeast Region. In this role, she oversees seven offices and is responsible for supervising a combined 108 national banks and federal savings associations. Tracy has over 32 years of bank regulatory experience within the OCC’s Midsize and Community Bank Supervision (MCBS) division. Prior to accepting the AsDC position in December 2023, Tracy served as the Assistant Deputy Comptroller (ADC) in the Boston Office since 2019. Tracy has broad experience, having served in various leadership roles and offices nationwide, including ADC in Schaumberg, IL, Problem Bank Specialist in OCC Headquarters, and ADC Analyst in Nashville, TN. Tracy is a member of the MCBS Risk Committee and the OCC’s Climate Risk Implementation Committee. Tracy graduated from the University of South Florida with a bachelor’s degree in Accounting and Finance.

Ray Dorado is the Acting Executive Deputy Superintendent for the Banking Division of the New York State Department of Financial Services (DFS). In this role, he oversees the Division’s four supervision business groups — Foreign and Wholesale Banking, Community and Regional Banking, Licensed Financial Services, and Real Estate Financing—as well as Banking Operations, which includes applications and subject matter expert groups. His career has focused on advising large financial institutions on regulatory compliance and corporate governance, as well as managing their transactions and their legal and reputational risk. For the last 5 years, he has been a senior banking regulator in New York. Outside of work, his other focus has been philanthropy and community service, including investor literacy, pro bono activities, and looking out for the welfare of 1,200 high school students in the Bronx.

The Audience

Usman Isiaka, the Deputy CEO of United Bank for Africa (America), poses a question at the 2024 Annual Regulator Roundtable.

Sponsorship & Future Events

Thank you to AML RightSource for sponsoring NYLIB’s 2024 Annual Regulator Roundtable. AML RightSource is a leading managed services firm focused on fighting financial crime. AML RightSource assists clients with their AML/BSA, transaction monitoring, client onboarding (KYC), enhanced due diligence (EDD), and risk management needs.

If you are interested in sponsoring future NYLIB events, please fill out this contact form, and a member of our team will reach out to you.

From Left to Right: Edward Lutz (President, NYLIB), Dustin Nofziger (Attorney, Pryor Cashman LLP), Margaux Howard (First Vice President, Valley Bank).

As NYLIB continues to plan events and meetings, we are open to suggestions on topics or issues that interest banks in the tri-state area. Subscribe to our mailing list below to stay informed on news and upcoming events.

Memorable Moments

Please enjoy more memorable moments from our evening here. We encourage you to download your favorite moments and share them on LinkedIn. Don’t forget to tag the New York League of Independent Bankers (NYLIB)!

Multifamily Commercial Real Estate Lending: Economic Challenges & Societal Benefits

On September 18th, NYLIB hosted a panel discussion on Multifamily Commercial Real Estate Lending: Economic Challenges & Societal Benefits moderated by Robert Smith, Executive Vice President and Chief Real Estate Advisor at Apple Bank.

On Wednesday, September 18th, NYLIB hosted a panel discussion on Multifamily Commercial Real Estate Lending: Economic Challenges & Societal Benefits moderated by Robert Smith, Executive Vice President and Chief Real Estate Advisor at Apple Bank. A distinguished panel discussed the interface of laws and regulations, subsidies, rent controls, rental rates, and cost structures affecting multifamily lending, as well as tensions between the societal goal of affordable rental rates and the economic stresses on these properties (and on owners and lenders) given the current legal framework.

FROM LEFT TO RIGHT: James Nelson, Principal and Head of Avison Young’s Tri-State Investment Sales Group; Robert Porto, Executive Director at Cushman & Wakefield VALUATION & ADVISORY; Robert Smith, Executive Vice President and Chief Real Estate Advisor at Apple Bank.; Edward Lutz, President of NYLIB; Nate Bliss, Chief of Staff to the Deputy Mayor for Housing, Economic Development, and Workforce; Joseph Condon, Counsel FOR LITIGATION & POLICY at the New York Apartment Association (NYAA).

Among other topics, the panel discussed the effects of the Housing Stability & Tenant Protection Act of 2019 (HSTPA) on the valuations and viability of rent-stabilized and rent-controlled multifamily buildings in New York, and the need for reform at the state level. The relative benefits of voucher programs such as Section 8 were discussed, with panelists noting that voucher programs cause less market disruption than rent controls while continuing to ensure housing affordability. The potential impacts of the new 485-x tax abatement were discussed, as well as the disincentive that imposing minimum construction wage requirements provides for building projects larger than 99 units. Various positive actions taken by the Mayor to increase the supply of affordable housing were discussed, including the Mayor’s “City of Yes” proposal that would represent the most significant reform to New York City zoning restrictions in many decades. The idea that New York City might take additional steps to reduce the expenses that it imposes on struggling landlords also was discussed. There was robust audience participation during the Q&A portion of the event.

Moderator

Robert Smith joined Apple Bank in July 1992 and is currently Executive Vice President, Chief Real Estate Advisor. He is responsible for all activities within the Real Estate Valuation and Advisory Division (REVAD) at Apple Bank as well as various related commercial real estate activities throughout the Bank.

With a career spanning over four decades, he has been involved in commercial real estate since 1980, working with leading real estate companies and financial institutions. He has experience as a real estate advisor and as a real estate reviewer and appraiser.

Mr. Smith has taught graduate-level commercial real estate courses as an adjunct at New York University's NYU-Schack Institute of Real Estate for the past 17 years. He currently serves as an Adjunct Instructor at Fordham University - Real Estate Institute (REI) Graduate School Degree program. He continues to serve as an Instructor for the Appraisal Institute (AI) and is a Certified USPAP instructor for the Appraisal Foundation (AF).

Panelists

James Nelson is Principal and Head of Avison Young’s Tri-State Investment Sales group, where he leads a group of three dozen professionals in the sale of multi-family, office, development, and retail properties. Avison Young is a full-service global real estate firm with 5,000 real estate professionals located in 120 offices in 20 countries.

Throughout his close to 25-year career, James has been involved in the sale of approximately 500 properties and loan sales for an aggregate value of over $5 billion dollars. Prior to joining Avison Young, James served as Vice Chairman of Cushman & Wakefield, where his team was ranked the number one Investment Sales broker nationwide in 2016. Previously, James was a partner and top producer for Massey Knakal for six of their last eight years and was named the company’s youngest partner in 2004.

James enjoys guest lecturing at Columbia, Fordham, NYU, Wharton, and his alma mater Colgate. He is a regular source for the Wall Street Journal, NY Times, and the NY Post, among others. He serves on the boards of the Real Estate Board of New York (REBNY), Counselors of Real Estate, SparkYouth NYC, and Young Men’s/Women’s Real Estate Association of New York (YM/WREA). He is also a co-founder of the Real Estate Services Alliance (RESA) and the Colgate Real Estate Council. You can learn about James’ book, The Insider's Edge to Real Estate Investing: Game-Changing Strategies to Outperform the Market, and James’ videos and podcast on his website.

Robert Porto, MAI, is an Executive Director with Cushman & Wakefield Inc. Valuation & Advisory. Bobby joined Cushman & Wakefield Valuation & Advisory as an intern in May 2003. He was subsequently hired as a full-time appraiser and real estate analyst in June 2004. Since joining the division, Bobby has worked on various appraisals of income-producing properties, including office buildings, industrial properties, retail and shopping centers, and special-use properties such as auto dealerships, golf courses, restaurants, and parking garages. His work scope includes feasibility studies, market surveys, and investment analyses. Bobby has been a member of the Gas Station/Convenience Store, Auto Dealership, Multifamily, Industrial, and Restaurant and Residential Development specialty practice groups. Bobby was promoted to Associate Director in July 2008, to Director in July 2010, Senior Director in April 2014, and Executive Director in June 2022.

In 2012, Bobby joined New York’s multifamily specialty practice group as a colleague of John T. Feeney, regional head of the Multifamily Practice Group. The group focuses on valuation and consulting assignments located within all five boroughs of New York City and Long Island. Assignments include cooperatives, existing and proposed condominium developments, proposed and existing rental developments, 80/20 and 70/30 mixed-use developments, Section 8 housing developments, Mitchell Lama developments, development sites, air rights, Low Income Housing Tax Credits, Inclusionary Housing and benefits related to sub-market financing. Bobby prepared the Hudson Yards Financing District Development and Revenue Report in support of the 2021 $452 million bond financing for the Hudson Yards Infrastructure Corporation. Bobby is qualified as an expert witness.

Nate Bliss is Chief of Staff to the Deputy Mayor for Housing, Economic Development and Workforce, where he supports an interdisciplinary team leading City Hall’s efforts to promote recovery and to build a stronger and more inclusive economy. Nate has 20 years of experience in public-private partnerships, including time in both the private sector and in government. His work has included the development of laboratory and life sciences space in his role as Vice President for Development and Construction at Taconic Partners, and neighborhood revitalization efforts in areas including Coney Island, Long Island City, Downtown Far Rockaway, and Staten Island's North Shore in his role as Senior Vice President at New York City Economic Development Corporation. Nate is a graduate of Columbia University and New York University, and has also taught at NYU's Schack Institute of Real Estate. He resides in Brooklyn with his wife and two sons, and is proud to live and work in the greatest city on earth.

Joseph Condon is Counsel for Litigation & Policy at the New York Apartment Association (NYAA). NYAA was recently formed via a merger between the Community Housing Improvement Program (CHIP) and the Rent Stabilization Association of New York, Inc. (RSA). It is a 501(c)(6) that represents a coalition of property owners and managers who provide the majority of affordable multi-family housing in the state of New York.

Prior to serving as Counsel for Litigation & Policy at NYAA, Joe served as General Counsel of CHIP. Founded in 1966, CHIP was a trade association for owners of over 400,000 rent-stabilized rental properties across New York City’s five boroughs. CHIP provided educational programming, compliance assistance, and legislative advocacy to its more than 4,000 members. CHIP supported its members in their mission to provide excellent and affordable housing, build a sense of community in their properties, and employ thousands of New Yorkers with their small businesses.

***

New York State Assemblyman Jake Blumencrantz was unexpectedly unable to participate in the panel discussion due to an impromptu political rally on Long Island. His view was conveyed that with less government intervention and more incentives for investment, the private sector can deliver the housing solutions that New York desperately needs.

The Audience

Vivek Baid, a commercial real estate lender at Metropolitan Commercial Bank, poses a question at the multifamily Commercial Real Estate lending event (Sept 2024)

Sponsorship & Future Events

If you are interested in sponsoring future NYLIB events, please fill out this contact form, and a member of our team will reach out to you.

From Left to Right: Dustin Nofziger (Attorney, Pryor Cashman LLP), Edward Lutz (President, NYLIB), Pinchus Raice (Attorney, Pryor Cashman LLP)

As NYLIB continues to plan events and meetings, we are open to suggestions on topics or issues that are of interest to banks in the tri-state area. Subscribe to our mailing list below to stay informed on news and upcoming events.

Memorable Moments

Please enjoy more memorable moments from our evening here. We encourage you to download your favorite moments and share them on LinkedIn. Don’t forget to tag the New York League of Independent Bankers (NYLIB)!

The Evolution of Technology & Banking

On April 4, 2024, the NYLIB community gathered for a panel discussion on The Evolution of Banking & Technology, moderated by Patrick Sells, a co-founder of True Digital Group. Panelists included John Verry, Managing Director of CBIZ PivotPoint Security; Krista Moore, a Solution Enablement Engineer with Finxact, a Fiserv company; Ray Ortega, the Chief Technology Officer for BBH Solutions; and Preeti Singh, leader of the New York Business Unit at Coforge. The event was proudly sponsored by Coforge.

On April 4th, the NYLIB community gathered for a panel discussion on the Evolution of Technology and Banking moderated by Patrick Sells, a co-founder of True Digital Group. Panelists included John Verry, Managing Director of CBIZ PivotPoint Security; Krista Moore, a Solution Enablement Engineer with Finxact, a Fiserv company; Ray Ortega, the Chief Technology Officer for BBH Solutions; and Preeti Singh, leader of the New York Business Unit at Coforge. The event was sponsored by Coforge.

FROM LEFT TO RIGHT: Patrick Sells (True Digital Group), John Verry (Managing Director, CBIZ PivotPoint Security), Krista Moore (Solution Enablement Engineer, Finxact), Ray Ortega (Chief Technology Officer, BBH Solutions), Preeti Singh (Head of NYC Metro, Coforge)

Discussion topics included uses and risks of artificial intelligence, core migration and next-gen core banking systems, the coming transition to passwordless authentication, effective management of technology vendors, and how community banks can leverage technology to reduce cost and increase efficiency.

The Moderator

Patrick Sells, co-founder of True Digital Group, moderated the panel discussion. Patrick is an award-winning entrepreneur and thought leader with a proven track record of driving innovation and transformation in the financial services industry. As American Banker's 2020 Digital Banker of the Year and co-founder of True Digital Group, he has developed a network designed for bankers to help foster innovation and transformation through collaboration.

Before founding True Digital Group, Sells served as the Chief Innovation Officer at NYDIG and Quontic Bank. During his time at Quontic, he was recognized as American Banker’s Digital Banker of the Year and played a key role in creating the foundation that led to Quontic being named Forbes' #1 Digital Bank in 2022. At NYDIG, he was responsible for the organization's partnerships with core provider companies such as Alkami, Fiserv, FIS, Q2, NCR, and Jack Henry. By interacting with nearly 1,100 financial institutions throughout his career, Sells has extensive experience in vendor management, fintech partnerships, digital transformation, banking innovation, and risk management.

Our Panelists

John Verry is the Managing Director of CBIZ PivotPoint Security. Over the past 21 years, John has guided thousands of organizations on their journey to become provably secure and compliant. A family man and foodie with a penchant for pop culture references, John deftly mixes wit and wisdom while sharing his deep knowledge of cyber security with both business and technical audiences as the host of The Virtual CISO Podcast.

Ray Ortega is the Chief Technology Officer for BBH Solutions. Prior to being named CTO, Ray was BBH’s Unified Communications Practice Manager, leading the teams responsible for unified communications, networking, security, and other key technologies. He has more than 21 years of experience in the technology industry, with expertise in financial, non-profit, life sciences, engineering, and manufacturing verticals. As CTO, Ray develops the BBH service offerings and leads a team of technologists that design, build, and support Voice, Data, and Video Solutions that are premise-based or hosted in BBH’s cloud environment.

Krista Moore is a Solution Enablement Engineer with Finxact, a Fiserv company. “Enable” being the operative word. She has worked with financial institutions at Fiserv for over 25 years. In different spaces, Krista has helped customers find solutions that help create efficiency and diligence in their operations. In the endless evolution of technical services, she seeks to translate new technologies into a practical and approachable solution. The range of solution experience allows Krista to tie each element to the next, creating a seamless environment to “enable” the business goals.

Preeti Singh leads the New York Business Unit at Coforge, where she plays a crucial role in supporting the firm's financial services clientele within the region through business and technological transformations. Coforge is a global digital services and solutions provider that leverages emerging technologies and deep domain expertise to deliver real-world business impact for its clients, including global, commercial, and community banks, as well as insurance companies, card and payment providers, and global investment managers. Coforge helps its financial services clients modernize their core and reimagine their processes, enabling them to develop new product strategies, adopt the cloud, leverage data, insights, and analytics to create personalized experiences for their customers, as well as help drive adoption and roll-out of Governance, Risk & Compliance initiatives.

The Audience

The Audience at the APRIL 2024 The Evolution of Technology & Banking Event

Event Sponsor:

THE COFORGE TEAM in attendance AT THE April 4th NYLIB EVENT

Sponsorship & Future Events

If you are interested in sponsoring future NYLIB events, please fill out this contact form, and a member of our team will reach out to you.

As NYLIB continues to plan events and meetings, we are open to suggestions on topics or issues that are of interest to banks in the tri-state area. Subscribe to our mailing list below to stay informed on news and upcoming events.

Memorable Moments

Please enjoy more memorable moments from our evening here. We encourage you to download your favorite moments and share them on LinkedIn. Don’t forget to tag the New York League of Independent Bankers (NYLIB)!

Commercial Real Estate Panel Discussion

On January 11, 2024, NYLIB hosted a commercial real estate panel discussion moderated by NYLIB President Edward T. Lutz. Panelists included Stijn Van Nieuwerburgh, Professor of Finance and Real Estate at Columbia Business School; Jade Rahmani, Managing Director at KBW; and Scott Singer, Principal and Co-Lead of Avison Young’s Tri-State Debt & Equity Finance team.

On January 11, 2024, NYLIB hosted a commercial real estate panel discussion moderated by NYLIB President Edward T. Lutz. Panelists included Stijn Van Nieuwerburgh, Professor of Finance and Real Estate at Columbia Business School; Jade Rahmani, Managing Director at KBW; and Scott Singer, Principal and Co-Lead of Avison Young’s Tri-State Debt & Equity Finance team.

FROM LEFT TO RIGHT: Jade Rahmani (Managing Director, KBW), Scott Singer (Principal and Co-Lead, Avison Young Tri-State Debt & Equity Finance team), Stijn Van Nieuwerburgh, (Professor of Finance & Real Estate, Columbia Business School), Edward T. Lutz (President, NYLIB)

A wide-ranging discussion was held that explored valuations in various commercial real estate sectors, trends, the future of the office, and what individuals with CRE portfolio responsibilities should be doing today.

The Moderator

NYLIB President Edward T. Lutz moderated the panel discussion. Ed’s distinguished career in banking has spanned over five decades. He is a former Regional Director for the FDIC’s New York Region, as well as a former community bank President and CEO. Ed has also served as a Director for several community banks. He currently serves as Director and Chairman of the Audit Committee for First Central Savings Bank.

Our Panelists

Stijn Van Nieuwerburgh is the Earle W. Kazis and Benjamin Schore Professor of Real Estate and Professor of Finance at Columbia University’s Graduate School of Business, which he joined in July 2018.

Professor Van Nieuwerburgh’s research lies in the intersection of housing, asset pricing, and macroeconomics. He has also served as an advisor to the Norwegian Minister of Finance, and has been a visiting scholar at the Central Bank of Belgium, the New York and Minneapolis Federal Reserve Banks, the Swedish House of Finance, the International Center for Housing Risk, and has contributed to the World Economic Forum project on real estate price dynamics.

Jade Rahmani joined KBW in 2007. As a Managing Director, Jade covers the commercial real estate finance sector. Previously, he was an Equity Analyst at Prudential Securities, covering industrial companies including aerospace and defense. Jade was named the #1 Stock Picker in Housing Durables in 2012 and 2015, and #3 in Earnings Estimate Accuracy in 2016 by StarMine.

Earlier in his career, Jade worked at UBS on strategic marketing initiatives and at Sidley Austin on real estate finance transactions. He received a BA in English from the University of Michigan, Ann Arbor and an MBA in Finance and Accounting from New York University's Leonard N. Stern School of Business.

Scott A. Singer is Principal and Co-Lead of Avison Young’s Tri-State Debt & Equity Finance team and a member of Avison Young's U.S. Capital Markets Executive Committee. Prior to joining Avison Young, Scott was President of The Singer & Bassuk Organization. He has arranged more than $10 billion of construction and permanent debt and equity financing on behalf of highly regarded New York City-based real estate family offices, developers, and institutional owners.

Some of Scott’s major NYC projects include The Crown Building at 730 Fifth Avenue, multiple assets in the Brooklyn Navy Yard, One Seaport Plaza (three times), MetLife Plaza in Long Island City, The Mark Hotel, 110 East 59th Street, 1700 Broadway (twice), 75 Wall Street (twice), and 636 11th Avenue (twice).

The Audience

Demetris Giannoulias, CEO of Spring Bank, in attendance at the January 2024 COMMERCIAL Real Estate Event

As NYLIB continues to plan events and meetings, we are open to suggestions on topics or issues that are of interest to banks in the tri-state area. Subscribe to our mailing list below to stay informed on news and upcoming events.

Memorable Moments

Please enjoy more memorable moments from our evening here. We encourage you to download your favorite moments and share them on LinkedIn. Don’t forget to tag the New York League of Independent Bankers (NYLIB)!

Annual Regulator Roundtable on Supervisory Priorities & Risks

On September 14, 2023, NYLIB hosted a regulatory panel discussion on supervisory priorities and risks moderated by Steve Bush, Chairman, President and CEO of Apple Bank. The supervisory panel featured prominent guest speakers from the Federal Deposit Insurance Corporation (FDIC), the Office of the Comptroller of the Currency (OCC), the Federal Reserve Bank of New York (FRBNY), the New York State Department of Financial Services (NYSDFS), and the Consumer Financial Protection Bureau (CFPB).

On September 14, 2023, NYLIB hosted a regulatory panel discussion on supervisory priorities and risks moderated by Steve Bush, Chairman, President and CEO of Apple Bank. The supervisory panel featured prominent guest speakers from the Consumer Financial Protection Bureau (CFPB), the Federal Deposit Insurance Corporation (FDIC), the Federal Reserve Bank of New York (FRBNY), the New York State Department of Financial Services (NYSDFS), and the Office of the Comptroller of the Currency (OCC).

FROM LEFT TO RIGHT: Steve Bush (Chairman, president & CEO, Apple Bank), Edward T. Lutz (President, NYLIB), Jessica Kaemingk (Deputy Regional Director, New York Regional Office, FDIC), Cassandra Huggins (Acting Principal Deputy Assistant Director, Office of Supervision Examinations, CFPB), Joanna McCarty (Assistant Counsel for Banking, NYSDFS), Michael Moriarty (Associate Deputy Comptroller for the Northeast Region, OCC), Won Chai (Assistant General Counsel, FRBNY)

The topics discussed included the lessons that banks should take away from the March 2023 bank failures; prudent management of risks arising from higher interest rates; commercial real estate market risks and discussion of recent interagency guidance on prudent loan accommodations for creditworthy borrowers; CFPB supervisory priorities (including with respect to junk fees, overdrafts, NSF fees, and artificial intelligence); regulatory expectations for relationships with fintechs; and cybersecurity best practices (including the critical importance of patch management). Resources highlighted by panelists are provided below.

Resources

Lessons from Bank Failures

CFPB Supervisory Priorities

Periodic Supervisory Highlights Publications

Managing Fintech Relationships

Interagency Guidance on Conducting Due Diligence on Financial Technology Companies: A Guide for Community Banks (August 2021)

Interagency Guidance on Third-Party Relationships: Risk Management (June 2023)

Federal Reserve SR 23-7 Letter re: Creation of Novel Activities Supervision Program (August 2023)

Our Moderator

Steve Bush, President and CEO of Apple Bank, served as the moderator of the panel discussion. Steve previously served as Executive Vice President and Chief Operating Officer at Apple Bank, with oversight for the bank's lending units, as well as financial, risk management, planning, and operating functions. He joined Apple Bank in 1992 from Chemical Bank, where he was a Vice President in the Asset and Liability Management and Finance Divisions.

Panelists

Won Chai is an Assistant General Counsel in the Supervision, Markets & Financial Services division of the Legal Function of the Federal Reserve Bank of New York. Won’s practice focuses on regulatory capital, liquidity, and foreign banking organizations. He also supports the market operations of the FRBNY on governance and trading matters. He joined the New York Fed in 2013.

Cassandra (“Casey”) Huggins is a Principal Deputy Assistant Director (Acting) for the Office of Supervision Examinations at the CFPB. Casey provides executive-level supervision to senior managers in the operational areas that support the Bureau’s supervisory function. She served as examiner-in-charge for the CFPB’s very first examination in 2011. Prior to joining the CFPB, Ms. Huggins served as a consumer compliance examiner at the Office of Thrift Supervision.

Jessica Kaemingk has served as a Deputy Regional Director in the FDIC’s New York Regional Office for the Division of Risk Management Supervision (RMS) since January 2020, overseeing financial institutions in the Northeast and participating in regional and nationwide regulatory matters. Prior to this role, Jessica served as an RMS Assistant Regional Director in the New York Regional Office. In 2022, she served as the Acting Regional Director for the New York Region.

Joanna McCarty is Associate Counsel in Banking at the New York State Department of Financial Services, working on a variety of financial services regulatory matters. Joanna practice supports all four groups of the Banking Division, including Mortgage, Foreign and Wholesale Banks, Community and Regional Banks, and Licensed Financial Services. She joined DFS in 2017 after working at two banking institutions.

Michael (“Mike”) Moriarty is an Associate Deputy Comptroller for the Northeast Region at the Office of the Comptroller of the Currency. In this role, Mike serves as an expert advisor to the Deputy Comptroller for Community Bank Supervision on all financial institution matters and provides executive direction for Midsize and Community Bank Supervision operations, including bank and thrift supervision, as well as personnel management. Prior to serving as Associate Deputy Comptroller, he served in various leadership roles at the OCC.

Mac Wilcox, President at Hanover Bank, in attendance at the September 2023 Regulator Roundtable

As NYLIB continues to plan events and meetings, we are open to suggestions on topics or issues that are of interest to banks in the tri-state area. Subscribe to our mailing list below to stay informed on news and upcoming events.

Memorable Moments

Please enjoy more memorable moments from our evening here. We encourage you to download your favorite moments and share them on LinkedIn. Don’t forget to tag the New York League of Independent Bankers (NYLIB)!

Bank Valuations and the M&A Environment Featuring Joseph Moeller of KBW

On March 23, 2023, Joe Moeller, Managing Director of Keefe, Bruyette & Woods (KBW), provided a timely presentation on bank valuations and the M&A environment at Pryor Cashman’s offices in Times Square. The event was sponsored by KBW.

JOE MOELLER, Managing Director of Keefe, Bruyette, & Woods, Inc. (KBW) Joseph Presenting on Bank Valuations and the M&A Environment

On March 23, 2023, Joe Moeller, Managing Director of Keefe, Bruyette & Woods (KBW), provided a timely presentation on bank valuations and the M&A environment at Pryor Cashman’s offices in Times Square. The event was sponsored by KBW.

Following cocktails and an opportunity for networking, Mr. Moeller provided an overview of recent market developments, including a comparison of recently failed banks and new areas of investor focus in light of recent developments. Mr. Moeller then provided a deep-dive into market conditions and bank valuations before discussing predictions for banking industry performance and the outlook for banking M&A. Mr. Moeller answered a number of questions from the audience, and a robust discussion was had.

NYLIB President Edward T. Lutz Providing Opening Remarks

NYLIB President Ed Lutz commented: “NYLIB thanks Joe Moeller and the KBW team for a timely and important presentation. The NYLIB team is thrilled that we were able to provide an opportunity to bring our colleagues together to explore key issues of importance to members of the banking industry. Our organization’s mission is to provide a forum for networking and education.”

FROM LEFT TO RIGHT: DUSTIN NOFZIGER (PRYOR CASHMAN LLP), CASEY CHRISTOPHER (QUONTIC BANK), Edward Lutz (NYLIB), PINCHUS RAICE (NYLIB & PRYOR CASHMAN LLP), BIANCA REYES (PRYOR CASHMAN LLP)

As NYLIB continues to plan events and meetings, we are open to suggestions on topics or issues that are of interest to banks in the tri-state area. Subscribe to our mailing list below to stay informed on news and upcoming events.

Memorable Moments

Please enjoy more memorable moments from our evening here. We encourage you to download your favorite moments and share them on LinkedIn. Don’t forget to tag the New York League of Independent Bankers (NYLIB)!

Our Sponsor

Previous Events

Event Featuring New York State DFS Superintendent Adrienne A. Harris

On January 12, 2023, New York State Department of Financial Services (DFS) Superintendent Adrienne A. Harris joined NYLIB for Q&A at Pryor Cashman’s offices in Times Square. The event was sponsored by K2 Integrity and Mazars.

New York State DFS Superintendent Adrienne A. Harris and NYLIB President Edward T. Lutz

On January 12, 2023, New York State Department of Financial Services (DFS) Superintendent Adrienne A. Harris joined NYLIB for Q&A at Pryor Cashman’s offices in Times Square. The event was sponsored by K2 Integrity and Mazars.

HAB BANK President & CEO Saleem Iqbal Asks SUPERINTENDENT HARRIS A QUESTION

Superintendent Harris answered a number of questions posed on behalf of NYLIB member banks by NYLIB President Ed Lutz. She spoke regarding her accomplishments during her first year as Superintendent, as well as the DFS’s supervisory priorities for 2023. She relayed her thoughts on safety and soundness concerns given the current macro environment, third-party risk management of fintechs, cybersecurity, expectations for regulated banks that wish to engage in virtual currency-related activity, DFS’s efforts to support the future of community banking, and why community and foreign banks should embrace DFS supervision. She also took audience questions on a variety of topics, including the viability of charging non-sufficient funds (NSF) fees, the potential future role of central bank digital currencies, best practices for promoting diversity and inclusion, and the implications of DFS’s proposed guidance relating to managing the financial risks posed by climate change for foreign banking organizations with home country regulators.

EVENT ATTENDEES: SERGE SONDAK, JOSEPH PISTILLI, RAFIQ BENGALI, AND PINCHUS RAICE

NYLIB President Ed Lutz commented: “NYLIB is grateful to the Superintendent for providing insightful and timely comments on supervisory priorities and issues of importance to NYLIB member banks and friends. The Superintendent’s willingness to engage directly with the bank community and to answer questions is remarkable, and feedback from attendees has been uniformly positive. Many thanks to our friends at K2 Integrity and Mazars for making this event possible.”

Memorable Moments

Please enjoy more memorable moments from our evening here. We encourage you to download your favorite moments and share them on LinkedIn. Don’t forget to tag the New York League of Independent Bankers (NYLIB)!

Our Sponsors

Previous Events

Cannabis Banking Panel Discussion

The NYLIB community gathered for a panel discussion about banking cannabis businesses moderated by Peter Su of Green Check Verified. Panelists included Dustin Nofziger, a member of the Financial Institutions Group at Pryor Cashman LLP; Neha Gosalia, a BSA/AML Lead Risk Expert Specialist from the Office of the Comptroller of the Currency’s Systemic Risk Identification Support & Specialty Supervision (SyRIS) unit; and Brett Rawls, Senior Vice President and Head of Correspondent & Specialty Banking at Valley National Bank.

Panelists From left to right: Dustin Nofziger (Pryor Cashman), Neha Gosalia (Office of the Comptroller of the Currency), Brett Rawls (Valley National Bank)

The NYLIB community gathered for a panel discussion about banking cannabis businesses moderated by Peter Su of Green Check Verified. Panelists included Dustin Nofziger, a member of the Financial Institutions Group at Pryor Cashman LLP; Neha Gosalia, a BSA/AML Lead Risk Expert Specialist from the Office of the Comptroller of the Currency’s Systemic Risk Identification Support & Specialty Supervision (SyRIS) unit; and Brett Rawls, Senior Vice President and Head of Correspondent & Specialty Banking at Valley National Bank. Casey Christopher, the Chief Empowerment Officer at Quontic Bank, provided opening remarks.

Moderator

Cannabis Banking Panel Discussion moderated by Green Check Verified’s Peter Su

Peter Su is a Senior Vice President with Green Check Verified, the top cannabis banking compliance software/consultancy in the space. A long-time banker, Peter has spent 20+ years in finance with stops at HSBC, Signature, Dime, and East West. He has personally spearheaded two separate cannabis banking programs and in his current role at Green Check is responsible for the growth of over 100 cannabis banking programs all over the country. A frequent speaker and a sought-after thought leader, he has been featured in Bloomberg, American Banker, Newsday, Rolling Stone, and others.

An active member of the cannabis community, Peter currently chairs the Banking and Financial Services Committee for the NYCCIA & HVCIA. He is also Vice Chair and founding member of the cannabis banking committee for ASTM Int'l. And, he is on the board of the Asian Cannabis Roundtable, serving as treasurer. Additionally, he writes for Rolling Stone Cannabis Culture Council.

Peter holds several designations: Accredited Cannabis Banking Professional (ACBP); Certified Treasury Professional (CTP); Certified Cannabis Banking Professional (CCBP); Certified Commercial Cannabis Expert (CCCE); and is Endocannabinoid Systems qualified.

Peter also previously served as an advisory panel board member for Pace University’s Lubin School of Business and is a U.S. Army veteran.

Featured Speakers

Panelists From left to right: Dustin Nofziger (Pryor Cashman), Neha Gosalia (Office of the Comptroller of the Currency), Brett Rawls (Valley National Bank)

Dustin Nofziger is a member of Pryor Cashman’s Financial Institutions Group, where he counsels financial institutions and FinTechs, executives, and investors on a wide range of regulatory, enforcement, and complex commercial matters.

Dustin advises financial institutions on regulatory issues, counsels clients undergoing regulatory examinations, conducts internal investigations, and defends clients in government enforcement actions and investigations involving state and federal regulatory agencies. Dustin works with clients supervised and regulated by agencies including the Federal Deposit Insurance Corporation, the Board of Governors of the Federal Reserve System, the Office of the Comptroller of the Currency, the National Credit Union Administration, the Financial Crimes Enforcement Network, the Bureau of Consumer Financial Protection, and the New York State Department of Financial Services. Dustin also provides strategic regulatory advice to FinTechs, including those in the blockchain space.

Neha Gosalia is a BSA/AML Lead Expert Risk Specialist within the Office of the Comptroller of the Currency‘s (OCC) Systemic Risk Identification & Support unit. In her 17-year regulatory career with the OCC, Neha has a vast array of experience from working as a safety and soundness examiner in community banks to serving as a compliance and BSA/AML examiner in midsize and large bank supervision. In her current role, she is focused on BSA/AML, providing technical consulting to OCC examiners and other divisions within the agency, performing quality assurance reviews of examination products, and serving as a resource to lead and conduct BSA examinations in large bank supervision. She has also collaborated on interagency assignments with the FDIC, Federal Reserve Bank, and CFPB.

Ms. Gosalia is based in New York City and holds an MBA from the Stern School of Business at New York University and a BBA in Finance & Marketing.

Brett Rawls serves as the Head of Correspondent and Specialty Banking at Valley National Bank. In this role, in addition to multiple unique business lines, he has oversight and management responsibilities for Valley’s Cannabis-related BusinessBanking Program.

Brett has dedicated the past 25 years to the financial services industry, beginning his career at The Federal Reserve Bank of Atlanta. He later joined Silverton Bank, serving as Regional Market Executive in Florida before relocating to Atlanta and taking responsibility for Business Development and Regional Office Support. In 2009, Brett and a team of 80 correspondent bankers established a Correspondent Division with CenterState Bank, working directly with over a thousand community financial institutions nationally over the next 10 years.

During his time with CenterState, Brett had the opportunity to serve in multiple roles. In addition to his Business Development, Marketing, and Payments Solutions responsibilities within the Correspondent Division, he also oversaw the Treasury Management and SBA departments for the commercial bank. He later served as Executive Vice President and Chief Experience Officer for the then $17B organization. Brett gained valuable insights as a leader and participant in 19 merger & acquisition implementation events at CenterState.

Brett earned a B.S. degree in Management, with certificates in Economics and Organizational Psychology from the Georgia Institute of Technology. He is also a graduate of the Florida School of Banking – University of Florida and a former instructor at several southeastern banking and operations schools.

From left to right: Aleidy Diaz-Wells (Mazars USA), Justin Gaffney (Mazars USA), Pinchus Raice (NYLIB & Pryor Cashman LLP), Michael Serao (First Central Savings Bank), Jason Quijano (First Central Savings Bank)

The NYLIB team is thrilled that we were able to provide an opportunity to bring our colleagues together to explore key issues of importance to members of the banking industry. Our organization’s mission is to provide a forum for networking and education.

From left to right: Suzanne Minnick (Valley National Bank), Pinchus Raice (NYLIB & pRYOR cASHMAN llp), Margaux Howard (Valley National Bank)

As we continue planning events and meetings, NYLIB is open to any suggestions on topics or issues that are of interest to the community and foreign banks in the tri-state area. Don’t forget to subscribe to our mailing list below, to stay informed on news and upcoming events.

From left to right: Bianca Reyes (Pryor Cashman LLP), Pinchus Raice (NYLIB & Pryor Cashman LLP), Casey Christopher (Quontic Bank), Dustin Nofziger (Pryor Cashman LLP)

Memorable Moments

Please enjoy more memorable moments from our Regulator Roundtable Dinner here. We encourage you to download your favorite moments and share them on LinkedIn. Don’t forget to tag the New York League of Independent Bankers (NYLIB)!

Previous Events

Regulator Roundtable Dinner Focusing on Supervisory Priorities & Risks

The NYLIB community gathered for dinner and a Regulator Roundtable dinner focusing on supervisory priorities and risks. The supervisory panel discussion was moderated by Steve Bush, President and CEO of Apple Bank, and featured prominent guest speakers from various government agencies, including the Federal Deposit Insurance Corporation, Office of the Comptroller of the Currency, New York State Department of Financial Services, and Federal Reserve Bank of New York.

From left to right: Frank Hughes, Regional Director (New York REGION), Federal Deposit Insurance Corporation; Bettyann Griffith, Vice President and Supervision Officer, Federal Reserve Bank of New York; Charles Shafer, National Bank Examiner, Office of the Comptroller of the Currency; Yolanda Ford, Deputy Superintendent, New York State Department of Financial Services; Steve Bush, President and CEO, Apple Bank

The NYLIB community gathered for dinner and a regulatory panel discussion focused on supervisory priorities and risks. The regulatory panel discussion was moderated by Steve Bush, President and CEO of Apple Bank, and featured prominent guest speakers from various government agencies, including the Federal Deposit Insurance Corporation (FDIC), Office of the Comptroller of the Currency (OCC), New York State Department of Financial Services (DFS), and Federal Reserve Bank of New York (FRBNY).

Moderator

Regulator Roundtable featuring Apple Bank’s Steve Bush

Steve Bush, the President and Chief Executive Officer of Apple Bank, served as moderator for the panel discussion. Steve previously served as Executive Vice President and Chief Operating Officer at Apple Bank, with oversight for the bank's lending units, as well as financial, risk management, planning, and operating functions. Steve joined Apple Bank in 1992 from Chemical Bank, where he was a Vice President in the Asset and Liability Management and Finance Divisions.

Featured Speakers

Frank Hughes is the Regional Director for the FDIC’s New York Region, which supervises almost 600 banks with $1.8 trillion in assets. In this role, Frank oversees the regional supervisory activities of over 400 team members for the Division of Depositor and Consumer Protection and for the Division of Risk Management Supervision. Frank is also a member of the FDIC’s Training Oversight Committee and Investment Advisory Group. Frank recently returned to his permanent position as the Regional Director in New York after serving as the Regional Director in the FDIC’s Atlanta Region.

Frank has over 33 years of industry experience and has been with the FDIC for a total of 30 years. Prior to his current position, Frank served as Deputy Regional Director and Assistant Regional Director, both for the Division of Risk Management Supervision in the New York Region. Before coming to the New York Region, Frank was a Senior Examination Specialist and Supervisory Examiner in the FDIC’s Kansas City Region. In addition, Frank has served as a Senior Capital Markets and Securities Specialist, Case Manager, and Instructor for the FDIC’s Asset/Liability Management School. Outside of the FDIC, Frank has served as President and Board member of a community bank in Kansas City, Missouri, and as a Senior Examiner with the Federal Housing Finance Agency.

Yolanda Ford is Deputy Superintendent of the Community and Regional Banks Unit within the New York State DFS, responsible for the regulatory supervision of community/regional banks and credit unions.

Yolanda was appointed as Deputy Superintendent in February 2016. Prior to that, she was appointed Assistant Deputy Superintendent in the Community and Regional Banks Unit in 2008 and spent 23 years in field examination and supervision roles in various sectors of the New York State DFS (formerly known as the New York State Banking Department).

Charles R. Shafer joined the OCC in 2009 and is currently a National Bank Examiner in the New York Field Office. Charles has spent the majority of his career examining community banks, but has experience participating in various examinations of large and midsized institutions as well. He recently served as a Team Leader in New York, focused on examiner training and development.

Bettyann Griffith is a Vice President and Program Head in the Supervision Group of the Federal Reserve Bank of New York; she leads the Regional and Community Financial Institutions (RCFI) function. The RCFI function is focused on developing and executing the supervisory strategy of regional and community state member banks and holding companies in the Second District that have total U.S. banking assets under $100 billion. The portfolio also includes supervised financial organizations headquartered in Puerto Rico. Prior to her current role, Bettyann was the department head of Risk and Analysis within the function. Bettyann began her career in the Federal Reserve Bank of New York as an internal auditor.

Links to resources discussed by the panelists during their remarks have been provided below.

FDIC Resources

Supervisory Insights (Summer 2022), https://www.fdic.gov/regulations/examinations/supervisory/insights/sisum22/si-summer-2022.pdf

Notification of Engaging in Crypto-Related Activities (Apr. 7, 2022), available at https://www.fdic.gov/news/financial-institution-letters/2022/fil22016.html

Computer-Security Incident Notification Final Rule (Nov. 18, 2021), available at https://www.fdic.gov/news/financial-institution-letters/2021/fil21074.html

Conducting Due Diligence on Financial Technology Companies: A Guide for Community Banks (Aug 27, 2021), available at https://www.fdic.gov/news/financial-institution-letters/2021/fil21059.html

FRB Resources

Engagement in Crypto-Asset-Related Activities by Federal Reserve-Supervised Banking Organizations (Aug. 16, 2022), https://www.federalreserve.gov/supervisionreg/srletters/SR2206.htm

Contact Information in Relation to Computer-Security Incident Notification Requirements (Mar. 29, 2022), https://www.federalreserve.gov/supervisionreg/srletters/SR2204.htm

Community Bank Access to Innovation through Partnerships (Sept. 2021), available at https://www.federalreserve.gov/newsevents/pressreleases/bcreg20210909a.htm

Conducting Due Diligence on Financial Technology Firms: A Guide for Community Banks (Aug. 2021), available at https://www.federalreserve.gov/newsevents/pressreleases/bcreg20210827a.htm

Computer-Security Incident Notification Requirements for Banking Organizations and Their Bank Service Providers (Nov. 18, 2021), available at https://www.federalreserve.gov/newsevents/pressreleases/bcreg20211118a.htm

CECL Resource Center, https://www.supervisionoutreach.org/cecl

OCC Resources

Acting Comptroller of the Currency Michael J. Hsu, Remarks at the TCH + BPI Annual Conference, Safeguarding Trust in Banking: An Update (Sept. 7, 2022), https://www.occ.gov/news-issuances/speeches/2022/pub-speech-2022-106.pdf

Acting Comptroller of the Currency Michael J. Hsu, Remarks before the Texas Bankers Association, Community Banking, Digitalization, and the OCC (Sept. 1, 2022), https://www.occ.gov/news-issuances/speeches/2022/pub-speech-2022-104.pdf

OCC Strategic Plan, Fiscal Years 2023-2027 (Sept. 2022), available at https://www.occ.treas.gov/publications-and-resources/publications/banker-education/files/occ-strategic-plan.html

Semiannual Risk Perspective, Spring 2022 (June 23, 2022), available at https://www.occ.treas.gov/publications-and-resources/publications/semiannual-risk-perspective/files/semiannual-risk-perspective-spring-2022.html

Computer-Security Incident Notification: Final Rule (Nov. 23, 2021), available at https://www.occ.gov/news-issuances/bulletins/2021/bulletin-2021-55.html

Conducting Due Diligence on Financial Technology Companies: A Guide for Community Banks (Aug. 27, 2021), https://www.occ.gov/news-issuances/bulletins/2021/bulletin-2021-40.html

Other Resources

Cybersecurity and Infrastructure Security Agency (CISA), Stop Ransomware, https://www.cisa.gov/stopransomware

Financial Services Information Sharing and Analysis Center (FS-ISAC), Community Institutions, https://www.fsisac.com/community-institutions

Upcoming Events

The NYLIB team is thrilled that we were able to provide an opportunity to bring our colleagues together to explore key issues of importance to members of the banking industry. Our organization’s mission is to provide a forum for networking and education.

Edward Lutz, President, NYLIB & President, Lutz Advisors, Inc.

As we continue planning events and meetings, NYLIB is open to any suggestions on topics or issues that are of interest to the community and foreign banks in the tri-state area. Don’t forget to subscribe to our mailing list below, to stay informed on news and upcoming events.

Memorable Moments

Please enjoy more memorable moments from our Regulator Roundtable Dinner here. We encourage you to download your favorite moments and share them on LinkedIn. Don’t forget to tag the New York League of Independent Bankers (NYLIB)!

Previous Events

NYC Commercial Real Estate Roundtable Featuring Ariel Property Advisors Founder Victor Sozio

NYLIB hosted a roundtable discussion for CEOs over dinner at Avra Madison Estiatorio in Manhattan on May 23, 2022. The event was attended by a number of our colleagues from the banking industry as well as the commercial real estate sector.

NYC Commercial Real Estate Roundtable Featuring Ariel Property Advisors Founder Victor Sozio

NYLIB hosted a roundtable discussion for CEOs over dinner at Avra Madison Estiatorio in Manhattan on May 23, 2022. The event was attended by a number of our colleagues from the banking industry as well as the commercial real estate sector.

The CEO Roundtable event featuring Ariel Property Advisors Founder Victor Sozio offered an engaging discussion and useful takeaways on key topics in New York City commercial real estate. Ronald Kremnitzer and Wayne Heicklen, partners in the Real Estate Group at Pryor Cashman, added the legal point of view to the discussion.

Keynote Speaker

NYC Commercial Real Estate Roundtable Featuring Ariel Property Advisors Founder Victor Sozio

Our keynote speaker was Victor Sozio, Founding Partner of Ariel Property Advisors and one of New York City’s leading commercial real estate brokers. Mr. Sozio provided insight into the state of the commercial real estate market in NYC. Mr. Sozio’s comments touched on investment sales trends, vacancy rates, prices, cap rates, and the political environment. He also discussed case studies on recent retail, office, and industrial transactions.

The Legal Perspective

NYC Commercial Real Estate Roundtable Featuring Pryor Cashman Partner Ronald Kremnitzer

Ronald Kremnitzer and Wayne Heicklen, partners in the Real Estate Group at Pryor Cashman, added the legal point of view to the discussion, including a focus on how the COVID-19 pandemic is continuing to affect both retail and residential real estate—and how the situations are shifting as landlords and tenants negotiate the terms of new and modified tenancy agreements.

Mr. Kremnitzer noted that while retail landlords are beginning to see some recovery, tenants are still seeking (and often getting) financial modifications to lease agreements. On the residential side, landlords spent much of the pandemic period “desperate” to attract renters, sometimes with 2-3 months of free rent and other enticements; however, the residential market is seeing an almost total reversal in favor of landlords, with residential rents at or higher than pre-pandemic rates.

NYC Commercial Real Estate Roundtable Featuring Pryor Cashman Partner Wayne Heicklen

Mr. Heicklen led a lively discussion of the most difficult challenges facing New York City in order to reach recovery to pre-pandemic levels, which included curbing crime, getting workers back to the office, and creating incentives for private sector developers to build affordable housing.

Upcoming Events

The NYLIB team is thrilled that we were able to provide an opportunity to bring our colleagues together to explore key issues of importance to members of the banking industry. Our organization’s mission is to provide a forum for networking and education.

Edward Lutz, President, NYLIB & President, Lutz Advisors, Inc.

As we continue planning events and meetings, NYLIB is open to any suggestions on topics or issues that are of interest to the community and foreign banks in the tri-state area. Don’t forget to subscribe to our mailing list below, to stay informed on news and upcoming events.

Memorable Moments

Please enjoy more memorable moments from our Cybersecurity Panel Discussion here. We encourage you to download your favorite moments and share them on LinkedIn. Don’t forget to tag the New York League of Independent Bankers (NYLIB)!

Previous Events

Cybersecurity Panel Discussion Featuring GroupSense CEO Kurtis Minder

NYLIB hosted a Cybersecurity Panel Discussion at the St. Cloud Rooftop at The Knickerbocker Hotel on March 31, 2022. The event was attended by a number of our colleagues from the banking and finance community as well as C-suite executive information officers. We were also joined by our friends at Pryor Cashman LLP.

NYLIB’s Cybersecurity Panel Discussion, a Hybrid event at the St. Cloud Rooftop at The Knickerbocker Hotel.

NYLIB’s Cybersecurity Panel Discussion last Thursday, March 31 at the St. Cloud Rooftop Bar was a tremendous success.

Kurtis Minder, CEO of GroupSense, speaking at Cybersecurity Panel Discussion hosted by NYLIB.

Keynote Speaker

Our keynote speaker, GroupSense CEO Kurtis Minder, delivered a presentation that was filled with useful information on topics like the steps that banks can take to prevent cyberattacks, the importance of reviewing cybersecurity insurance policies, and lining up cybersecurity and legal professionals in advance of an attack, and the need to print out hard copies of important electronic documents, such as incident response plans, to prevent such documents from being rendered inaccessible at exactly the wrong time by a ransomware attack. Mr. Minder also touched on techniques for negotiating with ransomware attackers and the importance of letting an experienced professional handle such negotiations. Mr. Minder, who earlier on Thursday had testified before the Senate Committee on Homeland Security, was profiled last year in a New Yorker article entitled “How to Negotiate with Ransomware Hackers.”

Regulatory Panelists

Our regulatory panel was capably moderated by John Verry of PivotPoint Security. We were honored that Jessica Kaemingk (Deputy Regional Director, FDIC), Jason Kang (National Bank Examiner and Bank Information Technology Specialist, OCC), and Danny Brando (Financial Institution Cybersecurity Policy Department Head, Supervision Group, Federal Reserve Bank of New York) joined us via Zoom. And we were both honored and delighted that Justin Herring (Executive Deputy Superintendent Cybersecurity Division, NYSDFS) was able to join us in person.

Key Takeaways

The regulators, who each spoke in their personal rather than official capacities, provided information and pointed to guidance regarding threats arising from the current geopolitical situation. They emphasized the importance of robust incident response and business continuity plans that specifically address cybersecurity risks and disruptions. They further emphasized that banks should account for the possibility of disruptions to third-party service providers in their business continuity plans. They commented on the importance of a strong board-level commitment to cybersecurity, as well as ways that chief information security officers (CISO) and other cybersecurity professionals can engage bank boards on the critical topic of cybersecurity.

Considerations for Banks & Financial Institutions

The federal regulators spoke regarding the impetus for the new federal interagency rule requiring banks to promptly report computer-security incidents reaching a certain materiality threshold to regulators and requiring bank service providers to do the same with respect to banks. They commented on the materiality standard under the new rule, and Mr. Herring also provided valuable insights regarding the standard for materiality under the New York State Department of Financial Services’ Part 500.

Here’s a word from Ed Lutz, the President of the New York League of Independent Bankers (NYLIB).

“In short, this was absolute ‘Must See TV’ for the community and foreign bankers. Kurtis Minder’s presentation was on point, and John Verry did a spectacular job moderating the regulatory panel.”

Here’s a word from Pinchus Raice, the co-founder and a Board Member of NYLIB, as well as a partner and co-chair of the Financial Institutions practice group at Pryor Cashman LLP.

“NYLIB greatly appreciate the participation and insights from our regulators on what is truly the topic du jour given the surge in ransomware cyberattacks in 2021 and the current risk of state-sponsored Russian cyberattacks on U.S. financial institutions in retaliation for U.S. support for Ukrainian sovereignty and independence.”

Upcoming Events

The NYLIB team is thrilled that we were able to provide an opportunity to bring our colleagues together to explore key issues of importance to members of the banking industry. Our organization’s mission is to provide a forum for networking and education.

From left to right: Dustin Nofziger (Counsel, Pryor Cashman), Edward Lutz (President, NYLIB & President, Lutz Advisors, Inc), Bianca Reyes (Business Development Specialist, Pryor Cashman), Pinchus Raice (Partner, Pryor Cashman)

As we continue planning events and meetings, NYLIB is open to any suggestions on topics or issues that are of interest to the community and foreign banks in the tri-state area. Don’t forget to subscribe to our mailing list below, to stay informed on news and upcoming events.

Memorable Moments

Please enjoy more memorable moments from our Cybersecurity Panel Discussion here. We encourage you to download your favorite moments and share them on LinkedIn. Don’t forget to tag the New York League of Independent Bankers (NYLIB)!

Previous Events

The Fintech Imperative

Thank you for joining us for The Fintech Imperative — a virtual event hosted in partnership with NYPAY.

Thank you for joining us for The Fintech Imperative — a virtual event hosted in partnership with NYPAY on Thursday, February 17, 2022.

In Case You Missed It

The event featured a panel discussion, Q&A session, and networking sessions via Zoom “breakout rooms.” Jeffrey Alberts, partner in Pryor Cashman’s Financial Institutions and FinTech practice groups, moderated the panel of speakers discussing the role of FinTechs in the banking industry. Panelists included Grace Pace, VP of Digital Banking at Quontic Bank, Keith Vander Leest, Payments Director at Cross River Bank, and Jeff Keltner, SVP and Co-Founder of Upstart. Please enjoy the recording of the virtual event below.

2021 Fall CEO Dinner Featuring Don Musso

NYLIB hosted a roundtable discussion for CEOs over dinner at Avra Madison Estiatorio in Manhattan on October 12, 2021. The event was attended by a number of our colleagues from the banking and finance community. We were also joined by our friends at Pryor Cashman LLP.

Donald J. Musso, President of FinPro, Inc. speaking at the CEO roundtable dinner event at Avra Madison.

NYLIB hosted a roundtable discussion for CEOs over dinner at Avra Madison Estiatorio in Manhattan on October 12, 2021. The event was attended by a number of our colleagues from the banking industry. We were also joined by our friends at Pryor Cashman LLP. In compliance with NYC requirements for restaurants, all participants were vaccinated.

Carlos Garcia (Founder & CEO, Finhabits), Pinchus Raice (Partner, Pryor Cashman), Steven Bush (Chairman, President & CEO, Apple Bank for Savings), Rizwan Qureshi (Senior Executive Vice President, HAB BANK)

Our guests had the opportunity to reconnect with colleagues and network with other banking executives. The NYLIB team views these meetings as an opportunity to bring people together to explore key issues of importance to members of the banking community.

Guest Speaker

Donald J. Musso, the President of FinPro, joined us as a guest speaker. Don Musso has founded many de novo banks and is a significant investor in many community banks. Musso is a recognized expert in value creation for banks, strategic planning, loan and deposit growth, internal risk assessments, asset/liability management, customer segmentation and delivery alternatives, and investment banking.

Guest Speaker: Donald J. Musso, President, FinPro, Inc

Don led the discussion on the challenges facing the industry from current monetary and fiscal policies, the impact on the industry as current levels of support from the government abate with particular emphasis on the consumer and commercial lending, the effects of competition on bank lending activities, and the stresses on bank performance deriving from continued tight spreads and the diminishing impact of PPP loans among other factors.

Upcoming Events

The NYLIB team is thrilled that we were able to provide an opportunity to bring our colleagues together to explore key issues of importance to members of the banking industry. Our organization’s mission is to provide a forum for networking and education.

From left to right: Dustin Nofziger (Counsel, Pryor Cashman), President, NYLIB & President, Lutz Advisors, Inc), Casey Christopher (Chief Empowerment Officer, Quontic Bank), Pinchus Raice (Partner, Pryor Cashman), Bianca Reyes (Business Development Specialist, Pryor Cashman)

We are planning events and meetings for next year and are open to any suggestions on topics or issues that are of interest to the community and foreign banks in the tri-state area. Subscribe to our mailing list below, to stay informed on news and events.

Memorable Moments

Please enjoy more memorable moments from our roundtable dinner NYLIB held on October 12, 2021, at Avra Madison Estiatorio.

Previous Events

2021 Summer CEO Dinner

NYLIB hosted an in-person dinner on August 18, 2021, at the Avra Madison restaurant that was attended by a number of our banking friends.

NYLIB hosted an in-person dinner on August 18, 2021, at the Avra Madison restaurant that was attended by a number of our banking friends. Although there was not a set program, the conversation followed the lines of what’s next for the economy, the challenges posed by courts and legal processes in New York State to collection efforts, the state of the commercial real estate market in the tri-state area, the various approaches taken to return to the office/work from home, and the challenges and opportunities presented by the continued consolidation in the community banking industry. In compliance with NYC requirements for restaurants, all participants were vaccinated.

Participants had the opportunity to reconnect with folks in the industry and to meet and get to know banking executives whom they had not met before. The feedback from the bank executives that attended was uniformly positive.

We at NYLIB view these meetings as an opportunity to bring people together to explore key issues of importance to members and to the industry in general. The organization’s mission is to provide a forum for networking and education, and, when appropriate, it seeks to advance members’ collective interests through discussions with regulators and comment letters.

We expect to have additional meetings and events as the year progresses and will provide notice to our members and friends as plans develop. We are open to any suggestions on topics or issues that are of interest to the community and foreign banks in the tri-state area.

2019 Fall Meeting

On December 5, 2019, the New York League of Independent Bankers hosted its Fall meeting at Pryor Cashman’s office located at 7 Times Square.

Pinchus Raice, a NYLIB co-founder and board member, hosted the evening on behalf of Pryor Cashman LLP. Raice is a partner in the firm's Banking & Finance, Corporate, and Litigation Groups, as well as the co-leader of its Financial Institutions practice.

Guests enjoyed cocktails and networking with fellow attendees, followed by dinner and a discussion about banking enforcement trends led by Katherine Lemire, who was recently appointed Executive Deputy Superintendent of the Department of Financial Services' newly created Consumer Protection and Financial Enforcement Division. Ms. Lemire joins the DFS with over twenty years of regulatory, risk, and compliance background advising in both the public and private sectors. She was most recently a Partner at StoneTurn, a global advisory firm.

2018 Summer Meeting Featuring the OCC

On May 2, 2018, the New York League of Independent Bankers hosted its Summer meeting at Pryor Cashman’s offices located at 7 Times Square.

Guests enjoyed cocktails, followed by dinner and a discussion led by Adrianna Bailey. As the Associate Deputy Comptroller for BSA/AML Compliance Supervision in the OCC's Compliance and Community Affairs department, Ms. Bailey serves as the senior-level expert advisor to the Deputy Comptroller for Compliance Supervision and the Senior Deputy Comptroller for Compliance and Community Affairs on all BSA/AML and Office of Foreign Assets Control (OFAC) supervision activities. Prior to assuming her current position in 2017, Ms. Bailey had been a BSA/AML Compliance Specialist within the BSA/AML Compliance Policy division since 2013. She previously held other positions at the OCC, including serving as a Bank Examiner (Compliance) in New York. Ms. Bailey is a Certified Regulatory Compliance Manager (CRCM) and a Certified Anti-Money Laundering Specialist (CAMS). She holds a B.S. in Business Administration from King's College in Pennsylvania and an MBA and Master's of Accountancy from the University of Scranton.

Ms. Bailey discussed current regulatory issues and areas of focus regarding BSA/AML and OFAC risk assessments, including what examiners look for and how detailed risk assessments need to be, amongst other topics.

2017 Winter Meeting Featuring New York Congresswoman Carolyn Maloney

On January 18, 2017, the New York League of Independent Bankers hosted its Winter meeting. Guests enjoyed a cocktail hour, followed by dinner and a discussion led by Congresswoman Carolyn B. Maloney (NY-12).

On January 18, 2017, the New York League of Independent Bankers hosted its Winter meeting at Pryor Cashman’s office located at 7 Times Square.

Pinchus Raice, a NYLIB co-founder and board member, hosted the evening on behalf of Pryor Cashman LLP. Raice is a partner in the firm's Banking & Finance, Corporate, and Litigation Groups, as well as the co-leader of its Financial Institutions practice.

Guests enjoyed a cocktail hour, followed by dinner and a discussion led by Congresswoman Carolyn B. Maloney (NY-12). Maloney discussed issues concerning the banking industry, including Dodd-Frank and other federal regulatory matters, as well as the outlook under the new administration. Guests were eligible for 1 CPE Finance credit.

2016 Fall Meeting Featuring Yolanda Ford

On September 14, 2016, the New York League of Independent Bankers hosted its Fall meeting. Guests enjoyed a cocktail hour, followed by dinner and a discussion led by Yolanda Ford, Deputy Superintendent of Banks at the New York Department of Financial Services Community & Regional Banks Unit.

On September 14, 2016, the New York League of Independent Bankers hosted its Fall meeting at Pryor Cashman’s office located at 7 Times Square.

Pinchus Raice, a NYLIB co-founder and board member, hosted the evening on behalf of Pryor Cashman LLP. Raice is a partner in the firm's Banking & Finance, Corporate, and Litigation Groups, as well as the co-leader of its Financial Institutions practice.

Guests enjoyed a cocktail hour, followed by dinner and a discussion led by Yolanda Ford, Deputy Superintendent of Banks at the New York Department of Financial Services Community & Regional Banks Unit. Ford's presentation highlighted relevant issues and evolving expectations from NYDFS on BSA, regulatory compliance, and safety and soundness for financial institutions.

2016 Summer Meeting